IBM got some help by currency fluctuations, but strategic imperatives revenue delivered growth.

Aided in part by currency rates, IBM reported a better-than-expected first quarter where "strategic imperatives" delivered double-digit revenue growth over the last 12 months and as-a-service sales hit an annual run rate of $10.7 billion.

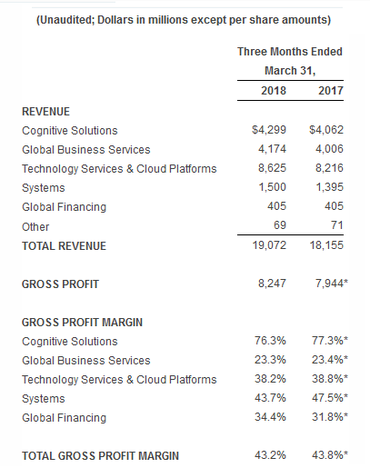

IBM reported non-GAAP first-quarter earnings of $2.45 a share on revenue of $19.1 billion, up 5 percent from a year ago. Adjusting for currency revenue was flat.

Wall Street was looking for first-quarter adjusted earnings of $2.42 a share on revenue of $18.82 billion.

On a net basis, IBM reported earnings of $1.81 a share, or $2.3 billion.

Read also: Enterprises learning to love cloud lock-in too: Is it different this time? | IBM says breached records dropped by nearly 25 percent to 2.9 billion last year | IBM Think 2018 postmortem: Making incumbent enterprises great again

Big Blue also maintained its outlook for 2018 and said it would deliver non-GAAP earnings of at least $13.80 a share. IBM also said it would deliver free cash flow of about $12 billion for 2018.

IBM's new businesses -- also known as strategic imperatives -- had revenue of $37.7 billion, up 12 percent over the last 12 months. In the first quarter, analytics revenue was up 9 percent with mobile up 19 percent. Security revenue in the first quarter was up 65 percent in the first quarter.

James Kavanaugh, CFO of IBM, said the following on a conference call with analysts.

Our first quarter results reflect much of the work we've done to reposition our portfolio and our skills to address the secular trends in the market, led by the phenomenon of data. We've been building new platforms and solutions while modernizing existing ones, embedding cloud and AI into more of what we offer. And so IBM is now a cognitive solution and cloud platform company focused on the high-value areas of IT.

By unit, IBM's cognitive solutions division had revenue of $4.3 billion, up 6 percent. Business services had revenue of $4.2 billion, up 4 percent, with technology services and cloud platforms delivering sales of $8.6 billion, up 5 percent. Systems revenue got a boost from IBM Z mainframe sales in the first quarter with revenue of $1.5 billion, up 8 percent.

Read also: IBM's cloud strategy revolves around multi-cloud support, grabbing new workloads | IBM launches Cloud Private for Data; elite data science consulting team | IBM launches 'skinny' Z mainframe designed for 19-inch standard data center rack

Here's a look at IBM's quarterly growth by product line.

A few notable items:

- Digital offerings are driving consulting growth and there were "modest" improvements in revenue in the first quarter relative to the fourth quarter.

- IBM Z sales were driven by the z14 and new workloads. IBM Z sales were up 54 percent from a year ago.

- Storage revenue declined after four straight quarters of growth.

- First quarter revenue in the Americas was flat with EMEA up 1 percent and the Asia Pacific flat. Americas revenue saw growth in Canada and Latin America and a decline in the US.

No comments:

Post a Comment